It can turn your company into a strong money-generating machine by giving your clients convenient access to Point-Of-Sale financing. Larger companies and supermarket chains, often providing their own in-house lines of credit, are no outsiders to finance portals. However, this can appear to be a capital intensive exercise for several small businesses that not only stresses you with the risk, but may also bring your clients out of pocket because of exorbitant APRs.

Sales Improved

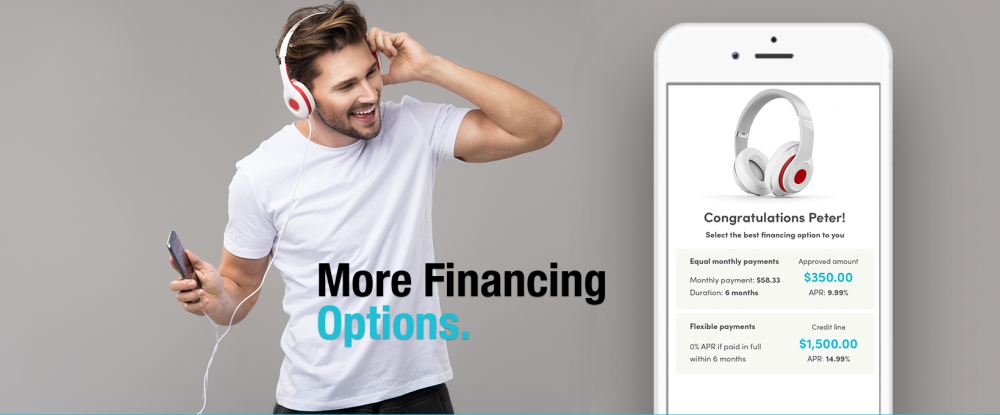

Limitless ways to boost revenue are by far the most enticing advantage of providing consumer financing. By encouraging customers to apply for loans on the spot with budget-friendly payment plans at no extra expense, it ensures that the company closes the deal just as easily and quickly. Some consumers do not have the money to pay upfront for bigger ticket items, such as furniture or appliances. However, if a company encourages the consumer to buy the product by using flexible purchase solutions that pay later, they are more than likely to purchase the product or service provided.

More Customers Return

What influences a client to finish a purchase? Affordability, openness, and productivity. To earn repeat clients, putting the purchasing power back into the hands of the consumer goes a very long way. Point of sale financing creates a comfortable online and in-store customer satisfaction. Without the trouble of lengthy procedures or long waits at the banks, they may apply for the loan on the door. The approval is instantaneous. And in order to place the cherry on top, even without hidden costs, consumers are given full clarity as to what their payment obligations will be every month.

Credit Checks Fewer Admin With

There are a few downfalls to providing conventional in-house credit like a store card. It can be an expensive exercise to set up for smaller companies and it brings a lot of needless admin. This choice demands that you do the application paperwork and also suggests that the burden for credit checks falls on your hands. First, you need to find out who a reputable credit check office is, look at how much risk the providing of credit entails, and decide how much credit you can give the consumer.